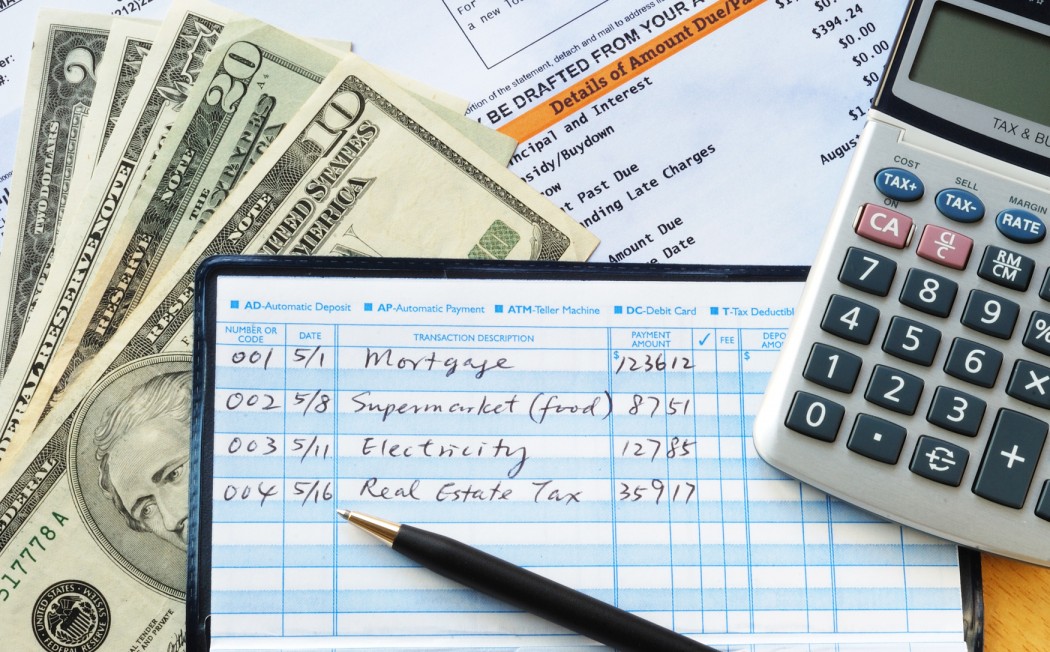

TO ADJUST AVERAGE MONTHLY INCOME FOR WHICH SOCIAL INSURANCE

Takes effect on February 11, 2017, the Circular No. 42/2016/TT-BLDTBXH dated December 28, 2016 of the Ministry of Labor, War Invalids and Social Affairs on indexing factor in calculation of average monthly income for which social insurance has been paid.

Accordingly, Indexed monthly wage as the basis for social insurance...

10 days before termination ATMS service providers must inform the locality state bank

On December 28, 2018, the State Bank of Vietnam issues the Circular No. 44/2018/TT-NHNN on amendments and supplements to certain articles of the Circular No. 36/2012/TT-NHNN dated December 28, 2012 of State Bank’s Governor prescribing installation, management, operation and maintenance of safety for operations of automated teller machines.

- Within...

Determining the presiding agency of a specific international investment dispute

On January 06, 2014, the State Bank of Vietnam issued the Circular No. 01/2014/TT-NHNN prescribing the delivery and receipt, preservation and transportation of cash, precious assets and valuable papers[...]

Cases under cancellation of transaction relationship with credit institutions

On December 5, 2013, the State Bank issued Circular No. 27/2013/TT-NHNN, amending and supplementing a number of articles of Ciruclar No. 02/2012/TT-NHNN dated February 27, 2012, on guiding foreign exchange transactions among the State Bank of Vietnam and credit institutions and foreign banks’s branches. [...]

Enterprises with a charter caplital of vnd 15 billion are entitled to create self-printed invoices

In accordance with the Circular No. 39/2014/TT-BTC guiding the implementation of the Government’s Decree No. 51/2010/ND-CP of May 14, 2010, and Decree No. 04/2014/ND-CP of January 17, 2014, on goods sale and service provision invoices[...]

After March 01, 2018, close current account of household fail to complete the change of account forms

Takes effect on March 01, 2017, the Circular No. 32/2016/TT-NHNN dated December 26, 2016 of the State Bank on amending the Circular No. 23/2014/TT-NHNN dated August 19, 2014 of the State Bank of Vietnam guiding the opening and use of payment accounts at payment service suppliers, before March 01,...

Approval procedure for activities of export, import of foreign currency in cash

On December 26, 2013, the Vietnam State Bank issued the Circular No. 33/2013/TT-NHNN providing guidelines upon approval procedure for activities of export, import of foreign currency in cash of permitted banks.

Under this Circular, commercial banks, branches of foreign banks permitted that have demand on export and import of foreign...

Approving list of high technologies prioritized for development investment

On November 25, 2014, the Prime Minister issued the Decision No. 66/2014/QD-TTg approving the list of high technologies prioritized for development investment and the list of hi-tech products eligible for development promotion.

Accordingly, from January 15, 2015, list of high technologies prioritized for development investment includes 58 technologies instead of...

To 2020, number of domestically manufactured and assembled vehicles is 67%

With the viewpoints that the automobile industry is an industry that creates an important motive force for promoting industrialization and modernization and should be encouraged through stable[...]

VISA EXEMPTION FOR OVERSEAS VIETNAMESE

Taking effect on November 15, 2015, the Decree No. 82/2015/ND-CP dated September 24, 2015 of the Government prescribing visa exemption for overseas Vietnamese and foreigners who are spouses or children of overseas Vietnamese or Vietnamese citizens, having a passport or an international travel document valid for at least 1...