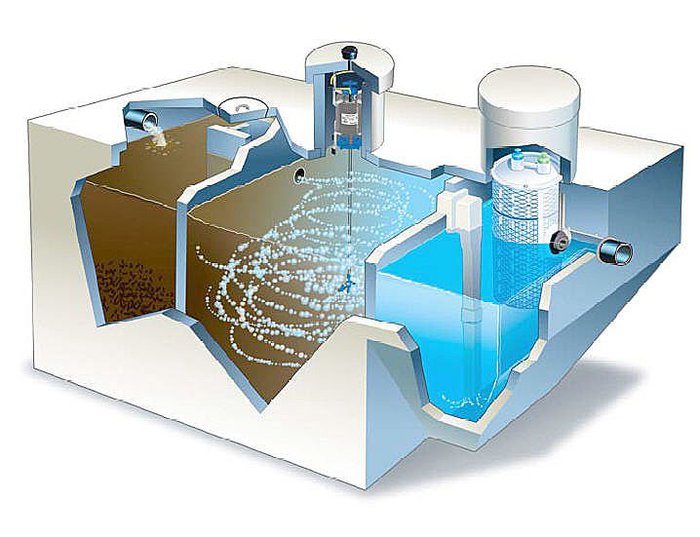

Decentralized wastewater treatment technologies

On April 03, 2015, the Ministry of Construction issued the Circular No. 04/2015/TT-BXD dated April 03, 2015 of the Ministry of Construction guiding the implementation of a number of articles of the Decree No. 80/2014/ND-CP dated August 06, 2014 of the Government on the waste water drainage and treatment.

Within...

Conditions for producing toxic chemical schedule 1

On May 06, 2014, the Government issued the Decree No. 38/2014/ND-CP on the management of chemicals subject to control under the Convention on the prohibition of the development, production, stockpiling and use of chemical weapons and on their destruction[...]

TO CHANGE THE PRINCIPLES OF THE MANAGEMENT BOARD OF A APARTMENT BUILDING

On December 15, 2016, the Ministry of Construction issued the Circular No. 28/2016/TT-BXD on amending the Circular No. 10/2015/TT-BXD providing regulations on professional training courses in management of apartment buildings, the Circular No. 11/2015/TT-BXD providing regulations on issuance of real estate broker license; guidelines for training and improving knowledge...

Receive 10% of the value of confiscated material evidences and fine payment on announcing administrative violationns

This is the content prescribed at the Circular No. 105/2014/TT-BTC dated August 07, 2014 of the Ministry of Finance amending, supplementing a number of articles of the Circular No. 153/2013/TT-BTC dated October 31, 2013[...]

Learn Universal Life Insurance Policies

In accordance with the Circular No. 52/2016/TT-BTC of the Ministry of Finance dated March 21, 2016 guiding the provision of universal life insurance products, an insurer must satisfy the following conditions such as its solvency margin is at least VND 100 billion larger than the minimum solvency margin; having...

To change organizational structure of Ministry of information and telecommunications

On October 16, 2013, the Ministry of Information and Telecommunications promulgated Decree No. 132/2013/ND-CP, defining the functions, tasks, powers and organizational structure of the Ministry of Information and Communications.[...]

The minimum amount of capital required for an airline is vnd 300 billion

This is the content prescribed at the Decree No. 92/2016/ND-CP dated July 1, 2016 of the Government providing for conditional business sectors or activities in the civil aviation industry and takes effect on July 01, 2016.

In particular, the minimum amount of capital required for establishment and maintenance of an...

Retail raw materials that contain addictive ingredients

In accordance with the Circular No. 19/2014/TT-BYT dated June 02, 2014 of the Ministry of Health managing the addictive drugs, psychotropic drugs, and drug precursor substances[...]

IN 2017, VIETNAM IMPORTS MORE THAN 50.000 DOZENS OF POULTRY EGGS

On March 03, 2017, the Ministry of Industry and Trade issued the Circular No. 03/2017/TT-BCT on prescribing principles of regulation of import tariff quotas for salt and poultry eggs in 2017.

This Circular also shows that the Ministry of Industry and Trade still remains import tariff quotas in 2017 for...

To reduce the ratio of poor households by 1.5% to 2% by 2015

This is one of important points prescribed in Solution No. 53/2013/QH13 dated November 11, 2013 of the 13th National Assembly on socio- economic development plan in 2014

In the next two years 2014- 2015, the National Assembly asks the Government to focus on shortcomings and weaknesses; to stabilize and restructure...