Temporary import of animal feeds for re-expor is exempted from quality inspection

December 24, 2014, the Ministry of Agriculture and Rural Development issued the Circular No. 50/2014/TT-BNNPTNT amending and supplementing a number of articles of the Circular No. 66/2011/TT-BNNPTNT dated October 10, 2011 of the Ministry of Agriculture and Rural Development detailing a number of articles of Decree No.08/2010/ND-CP dated 05/02/2010...

Female workers is prohibited to install high-voltage electric pylons

On October 18, 2013, the Ministry of Labor, War Invalids and Social Affairs issued the Circular No. 26/2013/TT-BLDTBXH promulgating the list of jobs in which the employment of female workers is prohibited[...]

CONDITIONS FOR FACTORING ACTIVITY

On May 17, 2017, the State Bank of Vietnam issued the Circular No. 02/2017/TT-NHNN stipulating on factoring activity of credit institutions, foreign banks’ branches.

The Circular prescribing that for customers being residents, factoring unit shall consider and decide on factoring when customers being legal status that has legal personality of...

TO VERIFY DEGREES AND CERTIFICATES OF THE SUCCESSFUL CANDIDATES

On August 31, 2015, the Ministry of Home Affairs issued the Circular No. 04/2015/TT-BNV on amending the Article 6 of the Circular No. 15/2012/TT-BNV dated December 25, 2012 of the Ministry of Home Affairs guiding the recruitment and signing the employment contracts and compensation for training costs applicable to...

Authorized representatives must possessing at least three years of experience

On February 14, 2014, the Ministry of Finance issued the Circular No. 21/2014/TT-BTC promulgating the Regulation on activities of authorized representatives for state capital invested in enterprises[...]

Staying overnight must register with local commune-level public security offices

In accordance with the Decree No. 34/2014/ND-CP dated April 29, 2014 on promulgating the Regulation on land border areas of the Socialist Republic of Vietnam, Vietnamese citizens (except border inhabitants) and foreigners entering land border areas and staying overnight shall register [...]

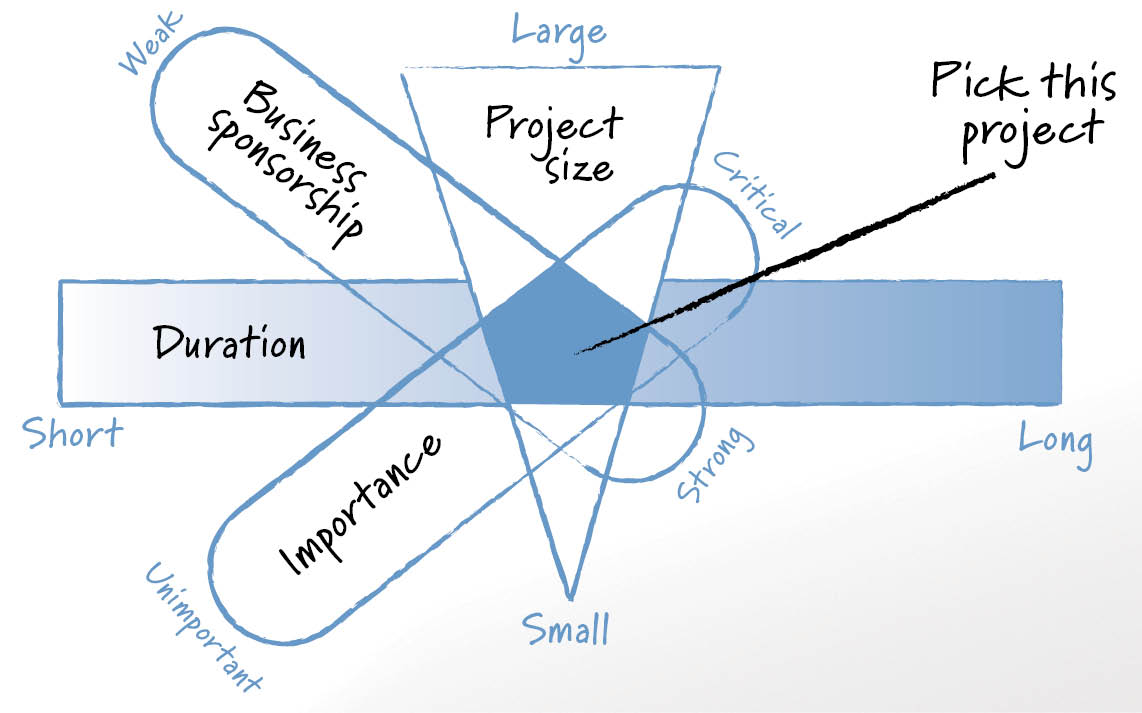

From 2018, to execute certain building information models (BIM) pilot projects

The Building Information Models (BIM) for facility building and operating management activities approved by the Prime Minister on December 22, 2016 at the Decision No. 2500/QD-TTg.

Accordingly, .with the objectives that through application of BIM, strive to achieve the objective of saving at least 30% of convertible general expenses for...

Must having payment of deposits for scraps import

This is the content of the Law No.55/2014/QH13 on Environmental Protection passed by the National Assembly on June 23, 2014.[...]

Safe investment ratio of proprietary trader that is commercial banks is 7%

This content is regulated in Circular No. 10/2016/TT-NHNN dated June 29, 2016 of the State Bank of Vietnam guiding a certain contents of the Decree No. 135/2015/ND-CP dated December 31, 2015 of the Government on prescribing offshore indirect investment.

According to this Circular, the safe investment ratio of a proprietary...

Principles to deal with 100% State-owned charter capital

On December 9, 2013, the Government promulgated Decree No. 206/2013/ND-CP on management of debts of enterprises with 100% State-owned charter capital[...]