To supplement 14 technologies banned from transfer

On December 17, 2014, the Government issued the Decree No. 120/2014/ND-CP on Amending and supplementing a number of articles of the Government’s Decree No. 133/2008/ND-CP of December 31, 2008, detailing and guiding the implementation of a number of articles of the Law on Technology Transfer, decides to supplement 14...

Limit on trading, providing interest rate derivative products

According to the Circular No. 01/2015/TT-NHNN dated January 06, 2015 of the Vietnam State Bank stipulating trading and provision of interest rate derivative products of commercial banks, foreign bank branches, credit institutions, foreign bank branches are permitted trading, providing and using interest rate derivative products when limit of net...

The detailed planning for seaports in the middle central vietnam (group 3)

On July 29, 2016, the Minister of Ministry of Transport issued Decision No. 2369/QD-BGTVT approving the detailed planning for seaports in the Middle Central Vietnam (Group 3) by 2020 and the orientation towards 2030, includes seaports of following coastal provinces: Quang Binh, Quang Tri, Thua Thien Hue, Da Nang,...

Decree 28/2015/NĐ-CP of government on 12/03/2015 on the detailed rules for implementation of some articles of the Law on Employment of unemployment insurance

According to Decree No. 28/2015 / ND-CP of the Government dated 12/03/2015 detailing the implementation of some articles of the Law on Employment of unemployment insurance (BHTN), the employer shall make and submit the dossier for participating unemployment insurance for employees within 30 days from effective date of labor...

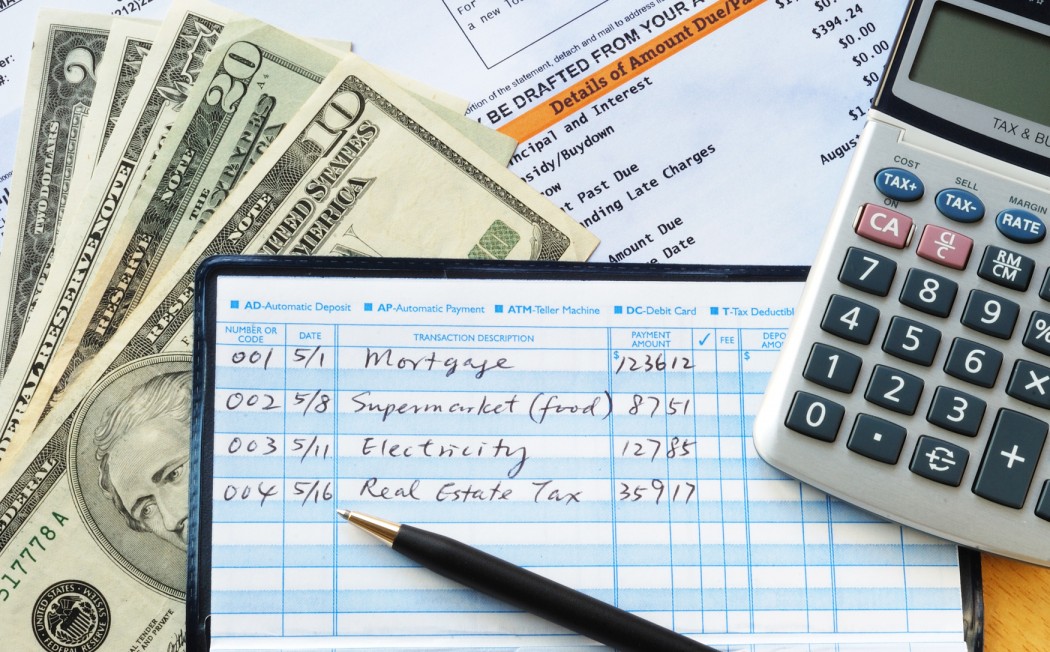

Adjusting salaries and monthly incomes for which the social insurance premiums

The Circular No. 58/2015/TT-BLDTBXH issued by the Ministry of Labor, War Invalids and Social Affairs on December 29, 2015 guiding the adjustment rate of salaries and monthly incomes for which the social insurance premiums have been paid.

In accordance with this Circular, the monthly salaries for which social insurance premiums...

Not carry out procedures for investment registration for domestic investment projects

On November 26, 2014, the National Assembly approved the Law No. 67/2014/QH13 on Investment with many new contents that have strong effects on domestic and foreign investors. First of all, the Law regulated that only investment projects of foreign investors and economic organizations having 51% or more of their ...

Ensure the cyber information security for the period 2016-2020

Orientation, objectives, duties of cyber information security for the period 2016-2020 approved by the Prime Minister at the Decision No. 898/QD-TTg dated May 27, 2016.

Accordingly, in order Creating the powerful change in awareness of information security and the rate of incidents of cyber information security loss; improving the reputation...

Guides on declaration of value-added tax and incentives for projects manufacturing supporting industry products

On February 05, 2016, the Ministry of Finance issued the Circular No. 21/2016/TT-BTC guiding on declaration of value added tax and priorities of enterprise income tax as stipulated under the Decree No. 111/2015/ND-CP dated November 03, 2015 on development of supporting industries.

Accordingly, for tax payers being organizations manufacturing supporting...

New regulations on maximum prices of dairy

At the Decision No. 1079/QD-BTC dated May 20, 2014 of the Ministry of Finance on measure application to stabilize the prices of dairy products for infants under 6, the Ministry of Finance provides detailed regulations on maximum price applied for 25 dairy products for [...]

AGRICULTURAL ENTERPRISES SHALL BE SUPPORTED WITH VND 1 MILLION/M2 IN BUILDING FACTORY

In accordance with the Circular No. 05/2014/TT-BKHDT issued by the Ministry of Planning and Investment on September 30, 2014 guiding the implementation of the Government’s Decree No. 210/2013/ND-CP of December 19, 2013, on incentive policies for enterprises investing in agriculture and rural areas. Enterprises may select the compliance with...