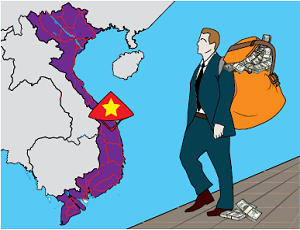

Foreign investor: Dear sir, We are limited company from hongkong and are looking setup my fifth office in Vietnam

We already have office in hongkong ,guanghzou.yiwu and qindao

We need to ask some information from you to setup trading or service office or representative office

- first time cost of setup company

- auditing cost monthly

- cost of company year renual or and accounting

- how much bank can recivd money limit like chia usd 50000 per id

- which city mainly do textile and fabric garment

- which city have whallsale market

We are seeking some support and help to setup Vietnam market

Lawyer of SBLAW: This is reference to your email below. I am Lawyer of SB Law and I was entrusted to provide you legal advice regarding to the matter below.

Per your question, please find our answers as follows:

(1) First time cost of setup company: Under Vietnam Law, foreigner who wishes to start up business in Vietnam must obtain an Investment Certificate.

Investment Certificate is considered as Certificate of Incorporation and Business Registration of the foreign invested company.

Success of obtainment of an Investment Certificate in Vietnam shall very much depend on

(i) proposed business lines of the Company;

(ii) proposed location of the company;

(iii) proposed capital of the company and

(iv) experience in the field of the relevant foreign investor. Consequently, our cost for setting up a foreign invested company also depend on above mentioned factors.

From your email, we understand that you would like to setup a foreign owned company for purchasing and exporting textile and fabric garment from Vietnam (please correct us if we are wrong).

For such business line, you can make an investment of about 150,000-300,000USD as charter capital for the company in Vietnam.

Our fee for setting up such company shall be 4,400USD (Four thousand and four hundred US Dollar).

The fee is inclusive of 10% VAT and the government fee. However, our fee is exclusive of cost for translation of your documents from English into Vietnamese (10USD/150 words and actual cost for traveling out of Hanoi or Ho Chi Minh City if you locate the company outside of Hanoi or Ho Chi Minh City).

(2). Auditing cost monthly: Under Vietnam Law, a law firm is not allowed to provide audit service. However, we can connect you with our business partner who is professional on auditing and accounting service if so required.

(3) Cost of company year renewal or and accounting: Every year, the company must pay business license tax which is similar to renewal fee for company in other countries. The business license tax shall be from 50USD-150USD/01 year. Regarding accounting service, we can connect you with our business partner who is professional on auditing and accounting service if so required.

(4) How much bank can receive money: There is not limit on the amount of money that a Bank in Vietnam can receive.

(5) Which city mainly do textile and fabric garment: Nam Dinh Province, Bac Ninh Province.

(6) Which city has wholesale market: Hanoi and/or Ho Chi Minh City.

We do hope that the above information may be helpful for you. If you have any further inquiry, please feel free to contact us.